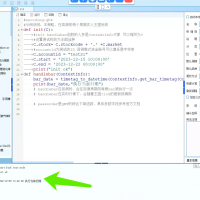

def daily_selection(ContextInfo):

"""每日选股任务 - 根据新策略修改"""

清空候选股池

clear_sector(CANDIDATE_POOL_NAME)

candidate_stocks.clear()

# 从配置文件指定的通达信板块路径获取股票列表

stock_list = []

try:

fixed_path = ContextInfo.tdx_sector_path.replace('\\', '/')

with open(fixed_path, 'r', encoding='gbk') as f:

raw_list = [line.strip() for line in f.readlines() if line.strip()]

# 转换股票代码格式

for raw_code in raw_list:

try:

formatted_code = get_code(raw_code)

if formatted_code != raw_code:

stock_list.append(formatted_code)

else:

logger.log(f"忽略无效代码格式: {raw_code}", level="WARNING")

except Exception as e:

logger.log(f"代码转换失败: {raw_code} - {str(e)}", level="WARNING")

except Exception as e:

logger.log(f"读取通达信板块失败: {str(e)}", level="INFO")

return

for stock_code in stock_list:

try:

# 获取日线数据(获取15天数据确保有足够历史数据)

df_daily = ContextInfo.get_market_data_ex(

fields=["close", "high", "low", "volume", "open"],

stock_code=[stock_code],

count=15,

period="1d",

dividend_type="front"

).get(stock_code)

if df_daily is None or len(df_daily) < 12: # 至少需要15天数据

logger.log(f"股票{stock_code}数据不足,跳过", level="WARNING")

continue

# 计算5日均线

close_prices = np.array(df_daily["close"])

ma5 = mt.MA(close_prices, 5)

# === 条件1: 倍量阳线+5日均线拐头 ===

last_index = len(df_daily) - 1 # 最新K线索引(昨日)

prev_index = last_index - 1 # 前一交易日

# 检查倍量阳线

prev_vol = df_daily["volume"].iloc[prev_index]

curr_vol = df_daily["volume"].iloc[last_index]

is_positive = df_daily["close"].iloc[last_index] > df_daily["open"].iloc[last_index]

volume_ok = curr_vol > ContextInfo.volume_multiple * prev_vol

# 检查5日均线拐头

ma5_turn_up = ma5[last_index] > ma5[prev_index] and ma5[prev_index] < ma5[prev_index-1]

# 排除天量/巨量

not_extreme = not is_extreme_volume(df_daily, last_index)

# 如果不满足条件1,跳过

if not (volume_ok and is_positive and ma5_turn_up and not_extreme):

continue

# 记录倍量阳线最低价

mark_low = df_daily["low"].iloc[last_index]

# === 条件2: 10日内最低价K线及区间检查 ===

# 在倍量阳线前10个交易日内寻找最低收盘价K线

search_start = max(0, last_index - 10) # 确保不越界

search_end = last_index # 搜索到倍量阳线的前一天

# 找到最低收盘价K线

min_close = float('inf')

min_index = -1

for i in range(search_start, search_end):

if df_daily["close"].iloc[i] < min_close:

min_close = df_daily["close"].iloc[i]

min_index = i

# 如果没有找到符合条件的K线,跳过

if min_index == -1:

continue

# 记录最低价K线的最高价

mark_high = df_daily["high"].iloc[min_index]

# 检查区间内收盘价是否都低于mark_high

# 区间:从最低价K线(min_index)到倍量阳线的前一天(last_index-1)

condition2 = True

# 遍历最近9天

for offset in range(1, 10):

# 如果最低价K线位置在offset天之前,则检查该天收盘价是否小于标记最高价

if min_index <= (last_index - offset):

if df_daily["close"].iloc[last_index - offset] >= mark_high:

condition2 = False

break

# 如果不满足条件2,跳过

if not condition2:

continue

# === 新增条件: RSI指标和总股本条件 ===

# 获取周线RSI

week_rsi_ok = False

try:

df_week = ContextInfo.get_market_data_ex(

fields=["close"],

stock_code=[stock_code],

count=4, # 获取7周数据

period="1w",

dividend_type="front"

).get(stock_code)

if df_week is not None and len(df_week) >= 6:

week_close = np.array(df_week["close"])

week_rsi = mt.RSI(week_close, 6)

week_rsi_ok = week_rsi[-1] > 50 if len(week_rsi) > 0 else False

except:

week_rsi_ok = False

# 获取月线RSI

month_rsi_ok = False

try:

df_month = ContextInfo.get_market_data_ex(

fields=["close"],

stock_code=[stock_code],

count=2, # 获取2个月数据

period="1month",

dividend_type="front"

).get(stock_code)

if df_month is not None and len(df_month) >= 6:

month_close = np.array(df_month["close"])

month_rsi = mt.RSI(month_close, 6)

month_rsi_ok = month_rsi[-1] > 50 if len(month_rsi) > 0 else False

except:

month_rsi_ok = False

# 总股本条件(小于10亿股)

total_shares = get_instrument_detail(stock_code, "total_shares")

total_ok = total_shares is not None and total_shares < 1000000000 # 10亿股

# 检查RSI条件

rsi_ok = week_rsi_ok or month_rsi_ok

# 如果所有条件满足

if rsi_ok and total_ok :

# 记录倍量阳线最低价

mark_low = df_daily["low"].iloc[last_index]

# 加入候选股池

candidate_stocks[stock_code] = {

"mark_low": mark_low, # 倍量阳线最低价

"mark_high": mark_high, # 最低价K线的最高价

"select_date": datetime.today().strftime("%Y%m%d")

}

add_stock_to_sector_custom(CANDIDATE_POOL_NAME, stock_code)

logger.log(f"加入候选股: {stock_code}, 最低价K线最高价:{mark_high:.2f}, 倍量阳线最低价:{mark_low:.2f}")

except Exception as e:

logger.log(f"处理股票{stock_code}时出错: {str(e)}", level="INFO")

if len(candidate_stocks) > 0:

logger.log(f"选股完成,新增{len(candidate_stocks)}只候选股", level="INFO")

for stock_code, info in candidate_stocks.items():

logger.log(f"入选股票: {stock_code}, 倍量阳线最低价: {info['mark_low']:.2f}, 突破阈值: {info['mark_high']:.2f}", level="INFO")

else:

logger.log("选股完成,候选股池为空", level="INFO") # 修改后

🔥迅投用户速速关注:论坛未公开的量化技巧5193 人气#QMT投研数据服务

🔥迅投用户速速关注:论坛未公开的量化技巧5193 人气#QMT投研数据服务 量化研究-上线强大miniqmt免费教学视频24 人气#量化经典

量化研究-上线强大miniqmt免费教学视频24 人气#量化经典 聚宽策略分享-1年化98国九条后中小板微盘小18 人气#量化经典

聚宽策略分享-1年化98国九条后中小板微盘小18 人气#量化经典 为什么回测不了自定时间1年前的1分钟周期32 人气#有问必答

为什么回测不了自定时间1年前的1分钟周期32 人气#有问必答